All incomes pay taxes, but the rate and types they pay are different. Tax policy is a critical component of our nation’s economic and fiscal landscape, but for individual Americans, the tax system can seem overly complex. Two of the most confusing factors? Marginal tax rates and tax breaks.

This complexity means that the percentage of income that Americans pay in taxes can vary widely and depend on many factors. The United States features a generally progressive income tax structure at the federal level. As income rises, so does an individual’s tax rate. At the same time, high-income Americans benefit disproportionately from tax breaks, otherwise known as tax expenditures. In 2022, such expenditures for individuals and corporations cost $1.7 trillion.

Let’s look at a few examples of how individual Americans would compute their income tax liabilities:

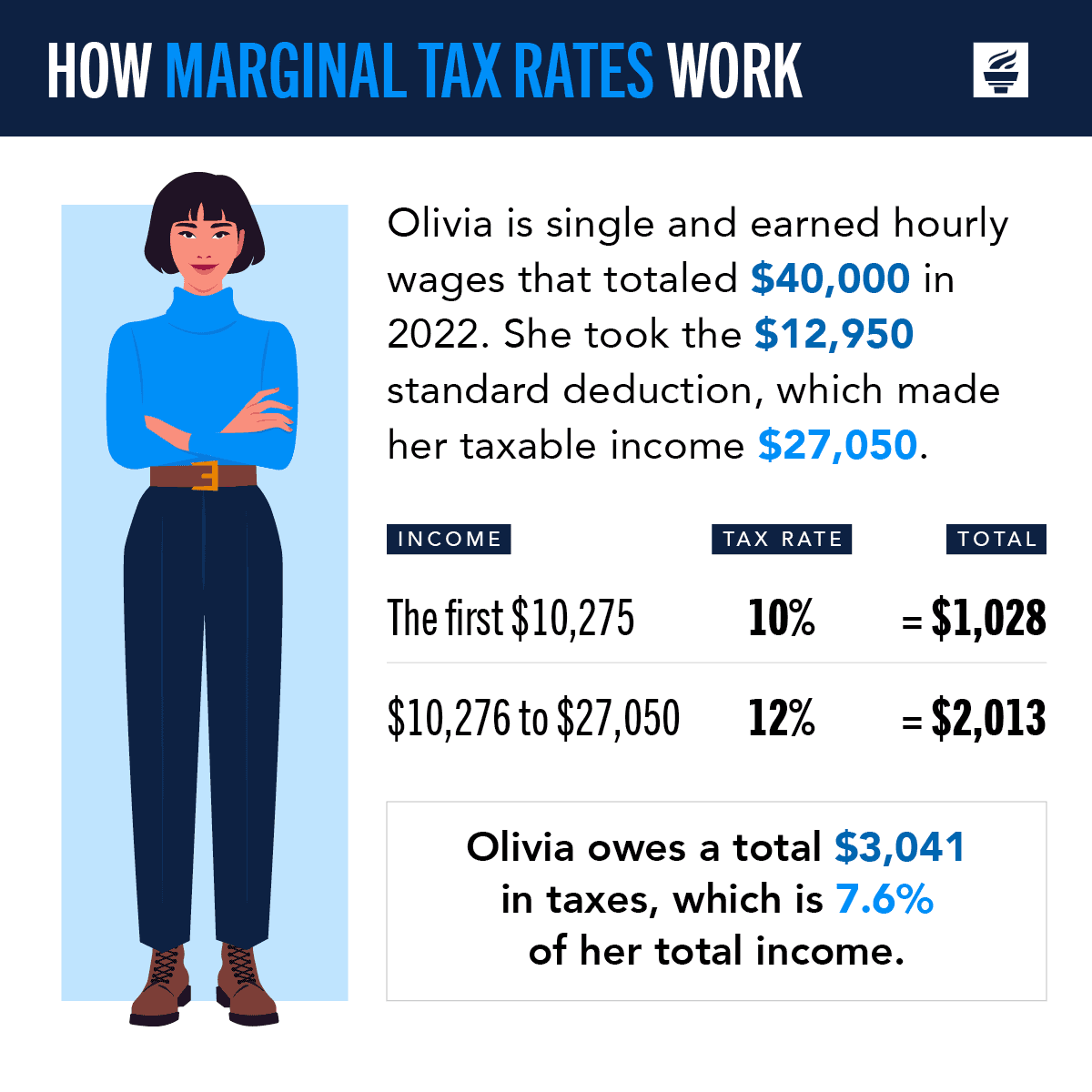

Scenario 1: Single, Part-Time Employee Making $40,000

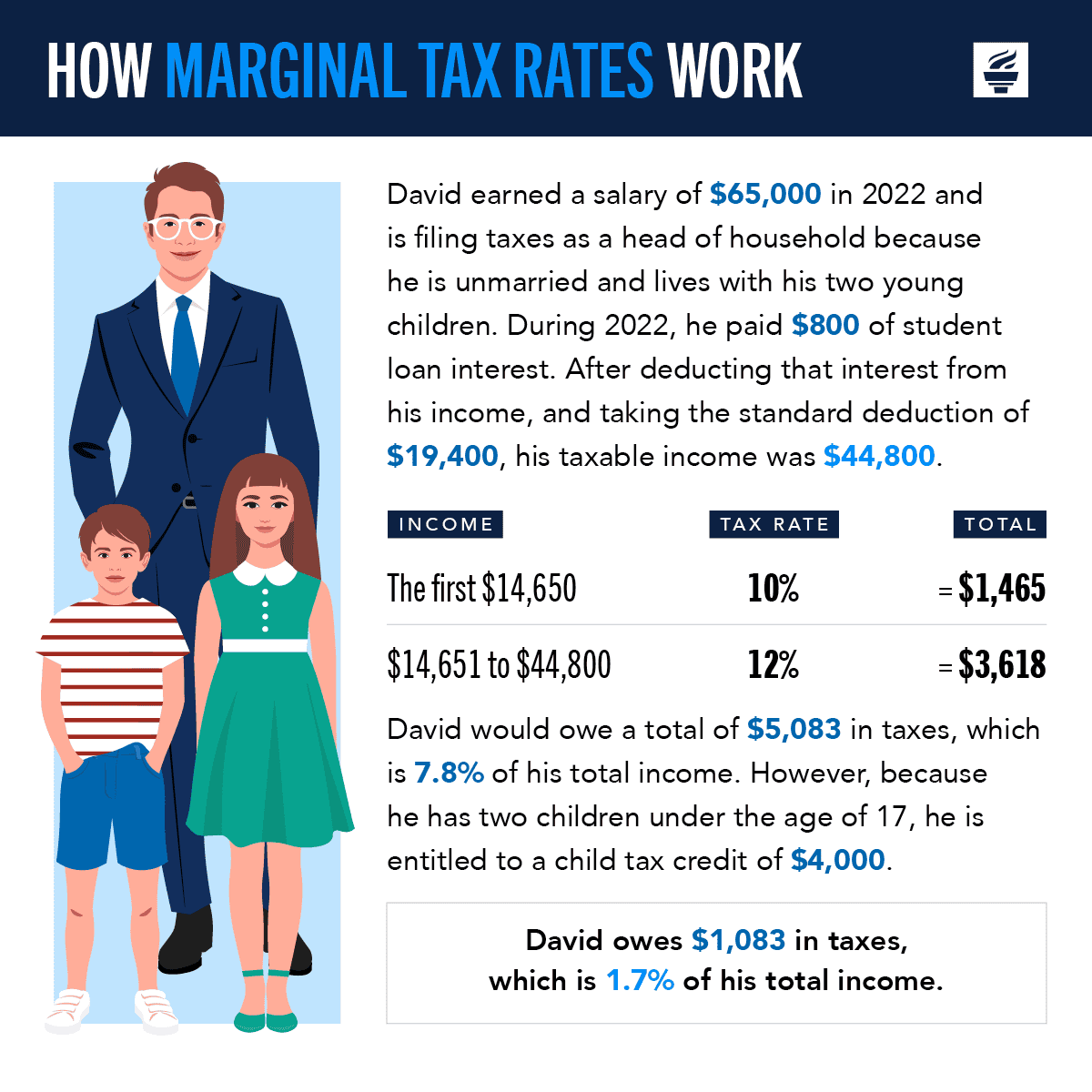

Scenario 2: Higher earning individual receiving the child tax credit

In the next example, David earns significantly more than Olivia, but he pays a lower percentage of his income, largely because he receives the child tax credit.

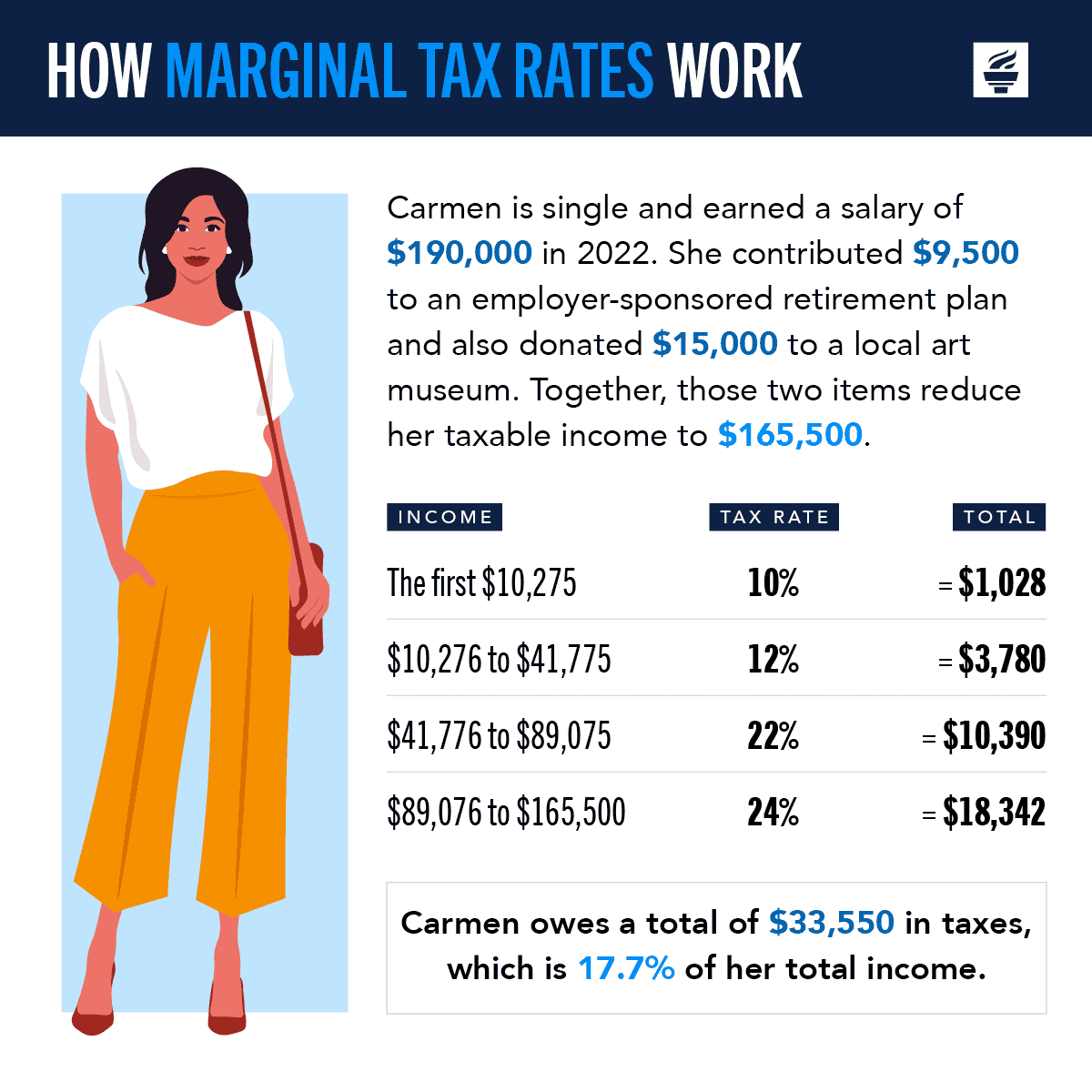

Scenario 3: Leveraging 401(k), IRA, and Charitable Deduction Tax Breaks

In the scenario below, Carmen reduced her taxable income in two ways. The first was by making contributions to an employer-sponsored retirement plan, such as a 401(k) or IRA. That is one of the most expensive tax breaks — it cost the government $288 billion in lost revenues in 2022. The second way that she reduced her taxable income was by making a charitable contribution.

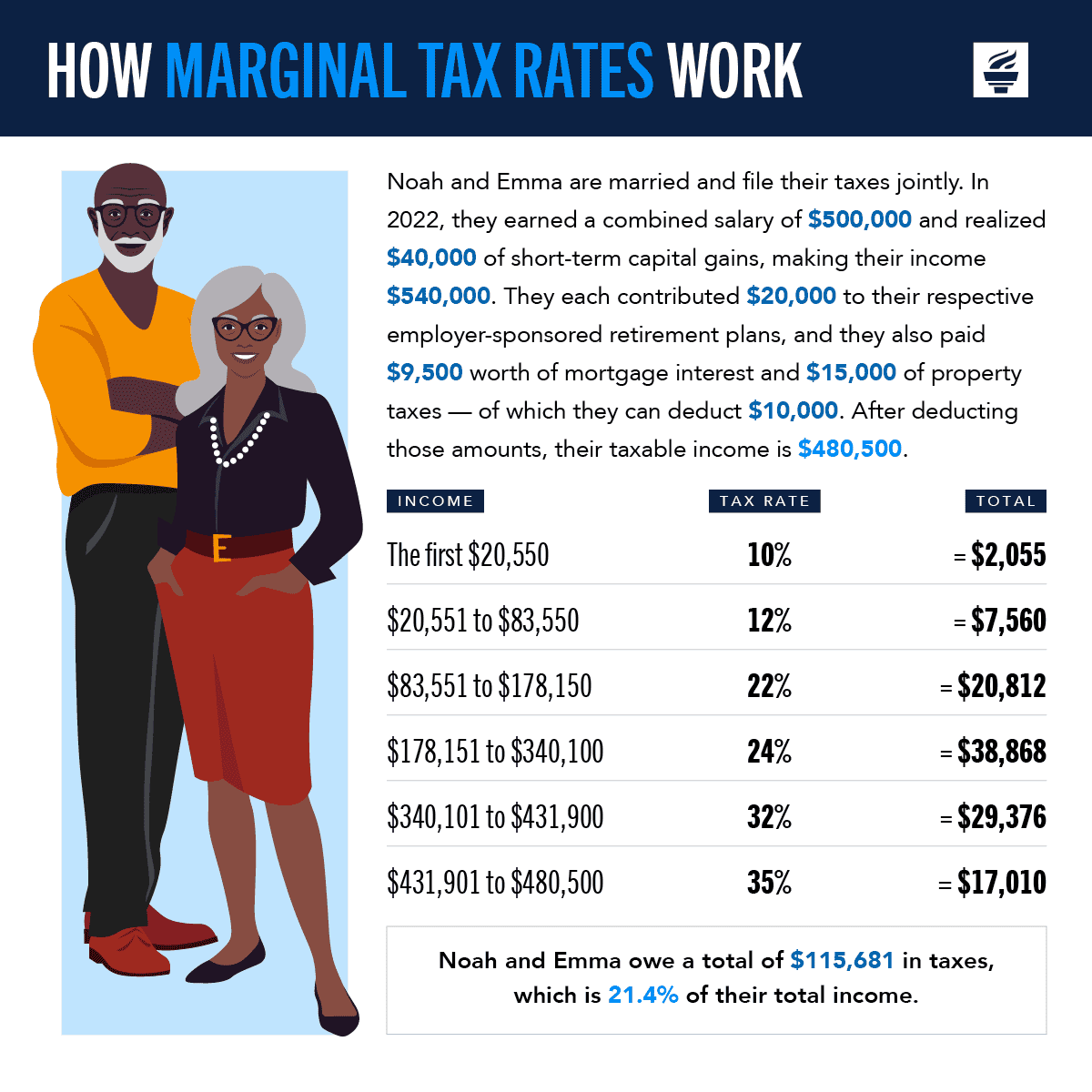

Scenario 4: Leveraging mortgage interest and SALT tax breaks

Noah and Emma are in the top percentile of income earners in the United States, and they are taking advantage of the mortgage interest and state and local tax (SALT) deductions — both of which tend to benefit high-income wage earners more than lower-income groups.

The Case for Simplifying the Tax Code

As the scenarios above illustrate, our tax system can be complex and confusing. While the fairness of that system is much debated, many economists agree that simplifying the tax code would promote economic growth and opportunity.

Further Reading

The Next Fiscal Cliff: Big Tax Decisions to Make in 2025

Some TCJA provisions were made temporary to limit the negative fiscal impact of the 2017 bill. It sets up a significant decision point for policymakers next year.

How Do We Tax the Top 1% — And What That Means for the Federal Budget

The top 1 percent pay a significant share of all federal taxes, while also benefitting disproportionately from preferential tax treatment.

What is Stepped-Up Basis on Capital Gains and How Does it Affect the Federal Budget?

The step-up in basis is a provision in tax law that relates to how assets — such as stocks, bonds, or real estate — are valued and taxed after their owner passes away.